Bitcoin is one of the most revolutionary inventions of the digital age—an asset, a technology, and in many ways, a movement. Created in 2009, it transformed how people think about money, value transfer, trust, and financial freedom. Yet despite its popularity, many still wonder: What exactly is Bitcoin? How does it work? And why has it become such a global phenomenon?

This comprehensive guide breaks down Bitcoin in clear, simple terms, covering its origins, technology, mining, transactions, uses, advantages, and risks.

What Is Bitcoin?

Bitcoin is a decentralized digital currency, meaning it exists only in electronic form and is not controlled by any government, bank, or company. Unlike traditional currencies such as the dollar or euro, Bitcoin:

-

Is not issued by a central bank

-

Relies on cryptography for security

-

Operates on a decentralized network of computers

-

Has a fixed supply of 21 million coins, making it scarce

-

Can be transferred globally, instantly, and securely

Bitcoin is often described as:

1. Digital Money

You can send it to anyone worldwide, similar to sending an email, but with encryption and without needing a bank.

2. A Store of Value

Because its supply is limited, many treat Bitcoin like digital gold—an asset that may hold value in the long term.

3. A Financial System

Bitcoin comes with its own rules, security system, and accounting ledger, called the blockchain.

Who Created Bitcoin?

Bitcoin was created by an unknown person or group using the pseudonym Satoshi Nakamoto.

In 2008, during the financial crisis, Satoshi published a short document called the Bitcoin Whitepaper, outlining a new form of electronic money that would not depend on banks.

On January 3, 2009, the Bitcoin network launched, and Satoshi mined the first block—called the Genesis Block. Shortly afterward, Satoshi disappeared, leaving the project to the global community.

This mystery adds a unique layer of intrigue to Bitcoin’s story.

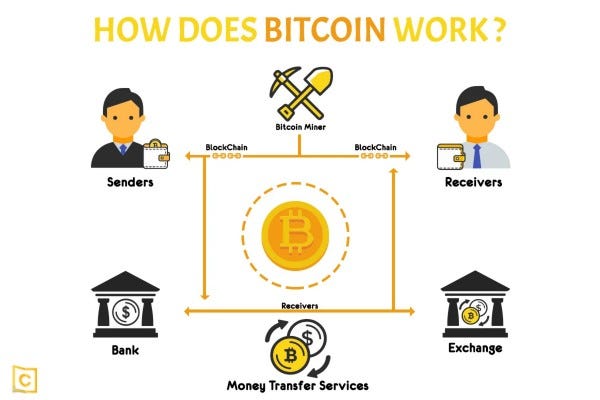

How Bitcoin Works: Understanding the Basics

Bitcoin works through a combination of technologies and decentralized principles. The core components are:

-

The blockchain

-

Nodes and the network

-

Mining

-

Proof-of-Work

-

Wallets and private keys

-

Transactions

Let’s break each one down.

What Is the Blockchain?

The blockchain is a public digital ledger that records every Bitcoin transaction ever made.

Imagine a notebook where every page contains a list of transactions. But once a page is filled and added to the notebook:

-

It cannot be edited

-

It is visible to everyone

-

It is cryptographically secured

Each page in this notebook is a block, and the notebook itself is the blockchain.

Why the Blockchain Matters

-

It ensures transparency — anyone can verify transactions

-

It prevents fraud — no one can change past records

-

It allows decentralization — no single entity controls the ledger

This creates trust without needing a bank or authority.

Nodes: The Computers That Run Bitcoin

Bitcoin’s network is made up of thousands of computers globally called nodes.

Nodes:

-

Store a full copy of the blockchain

-

Validate transactions

-

Enforce the rules of the system

Because so many independent nodes exist:

-

The network is extremely difficult to hack

-

It cannot be shut down

-

It remains neutral and censorship-resistant

Nodes are essential in keeping Bitcoin secure and decentralized.

Bitcoin Mining and Proof-of-Work

Mining is the process that keeps the Bitcoin network running. Miners use powerful computers to solve mathematical puzzles. When a miner solves a puzzle, they:

-

Add a new block to the blockchain

-

Confirm transactions

-

Receive a reward in Bitcoin

This process is called Proof-of-Work (PoW).

Why Mining Is Important

-

It protects the network from attackers

-

It ensures only valid transactions are added

-

It creates new bitcoins according to a schedule

Bitcoin’s Fixed Supply

Only 21 million bitcoins will ever exist. Mining is the method through which new Bitcoin is introduced into the system, and the reward is gradually reduced through events called halvings, which occur every four years.

This scarcity is one of the reasons Bitcoin is compared to gold.

Bitcoin Transactions: How They Work

When you send Bitcoin, here’s what happens:

-

The transaction is created using your wallet and private key.

-

It broadcasts to the Bitcoin network.

-

Nodes verify the details.

-

Miners include it in the next block.

-

Once confirmed, the BTC belongs to the recipient.

Public and Private Keys

Your Bitcoin wallet consists of two key components:

-

Public key / Address — like your email address; safe to share

-

Private key — like your password; must never be shared

Possession of the private key = ownership of the Bitcoin.

Is Bitcoin Anonymous?

Bitcoin is pseudonymous, not anonymous.

Your identity is not directly tied to your wallet address, but:

-

All transactions are public

-

Anyone can trace transaction history

-

Exchanges may require identity verification

Privacy-focused techniques exist, but Bitcoin itself is transparent.

What Can Bitcoin Be Used For?

While Bitcoin started as a peer-to-peer payment system, its use cases have expanded:

1. Investment and Store of Value

Many buy Bitcoin as a long-term asset, hoping its value will rise.

2. Global Payments

Bitcoin allows:

-

Instant cross-border transfers

-

Lower fees than banks

-

No need for intermediaries

3. Inflation Hedge

In countries with unstable currencies, Bitcoin is used as protection against inflation.

4. Remittances

Useful for sending money home cheaply and quickly.

5. E-commerce

More online businesses now accept Bitcoin.

6. Financial Freedom

Bitcoin allows people to control their own money without relying on institutions.

Why Do People Value Bitcoin?

People believe in Bitcoin for several reasons:

1. Scarcity

A fixed supply of 21 million coins makes it resistant to inflation.

2. Decentralization

No government or corporation controls it.

3. Security

The Bitcoin network is one of the most secure systems ever created.

4. Global Acceptance

Millions use it, and institutions invest heavily in it.

5. Independence

Users control their own assets, not banks or payment processors.

Risks and Challenges of Bitcoin

Bitcoin has great potential but also notable risks.

1. Price Volatility

Its price can rise or fall dramatically within short periods.

2. Regulation

Governments may attempt to restrict or regulate crypto.

3. Security Risks

While the network is secure, users must protect their private keys.

4. Energy Consumption

Mining uses large amounts of electricity, often criticized by environmental groups.

5. Irreversible Transactions

If you send Bitcoin to the wrong address, you cannot reverse the transaction.

6. Market Manipulation

As with any asset, large investors can influence price movements.

Is Bitcoin Legal?

In most countries, Bitcoin is legal to own and use.

Some nations regulate it as:

-

A commodity

-

A digital asset

-

A currency alternative

Others restrict or ban it, although bans sometimes fail due to Bitcoin’s decentralized nature.

Bitcoin vs Traditional Money

Bitcoin:

-

Limited supply

-

Decentralized

-

Borderless

-

Peer-to-peer transactions

-

Transparent ledger

-

Cannot be counterfeited

Traditional Money:

-

Controlled by central banks

-

Can be printed without limit

-

Subject to inflation

-

Requires banks and intermediaries

Bitcoin represents a shift in how people interact with money—more like a digital gold than everyday cash.

The Future of Bitcoin

Bitcoin’s future is widely debated. Some believe:

-

It will become global digital gold

-

It will surpass traditional assets

-

It will reshape finance

-

It will continue gaining institutional adoption

Others think:

-

It may face regulatory challenges

-

Volatility will limit its use

-

Competition from other cryptocurrencies could grow

Regardless, Bitcoin has already changed the world.

Conclusion

Bitcoin is far more than digital money—it is a technological innovation, a financial revolution, and a new economic philosophy. Its decentralized nature, limited supply, and global accessibility make it a unique asset unlike anything before.

Understanding Bitcoin—what it is, how it works, and why it matters—is essential as the world moves deeper into the digital era. Whether you see it as an investment, a currency, or a technological breakthrough, Bitcoin has undeniably transformed the future of finance.

Read Also: Keep your face towards the sunshine and shadows will fall behind you

Watch Also: https://www.youtube.com/@TravelsofTheWorld24

Leave a Reply