What is crypto trading and how do you trade cryptocurrencies?

Discover more about trading the volatile – and risky – cryptocurrency markets. Learn how to take a position with CFDs, and then see an example of a crypto trade on ether.

What’s cryptocurrency trading?

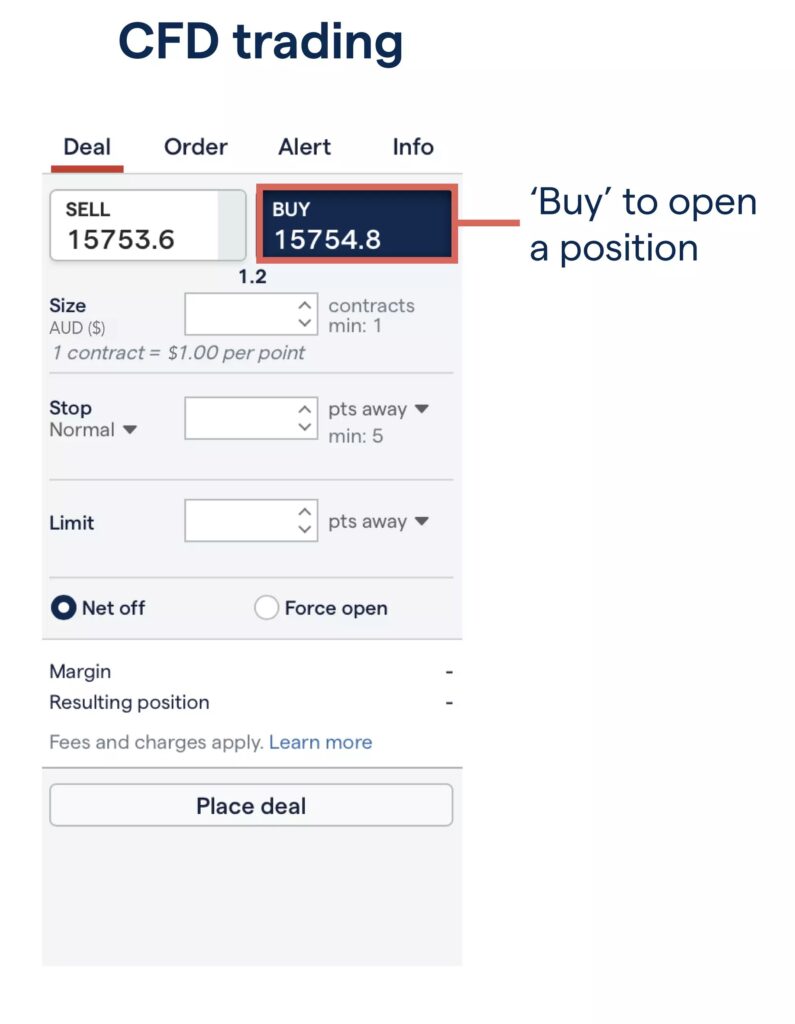

Cryptocurrency trading is the buying and selling of cryptocurrencies on an exchange. With us, you can trade cryptos by speculating on their price movements via CFDs (contracts for difference).

CFDs are leveraged derivatives – meaning that you can trade cryptocurrency price movements without taking ownership of any underlying coins. When trading derivatives, you can go long (‘buy’) if you think a cryptocurrency will rise in value, or go short (‘sell’) if you think it will fall.

By contrast, when you buy cryptocurrencies on an exchange, you buy the coins themselves. You’ll need to create an exchange account, put up the full value of the asset to open a position, and store the cryptocurrency tokens in your own wallet until you’re ready to sell.

Crypto:

How do cryptocurrency markets work?

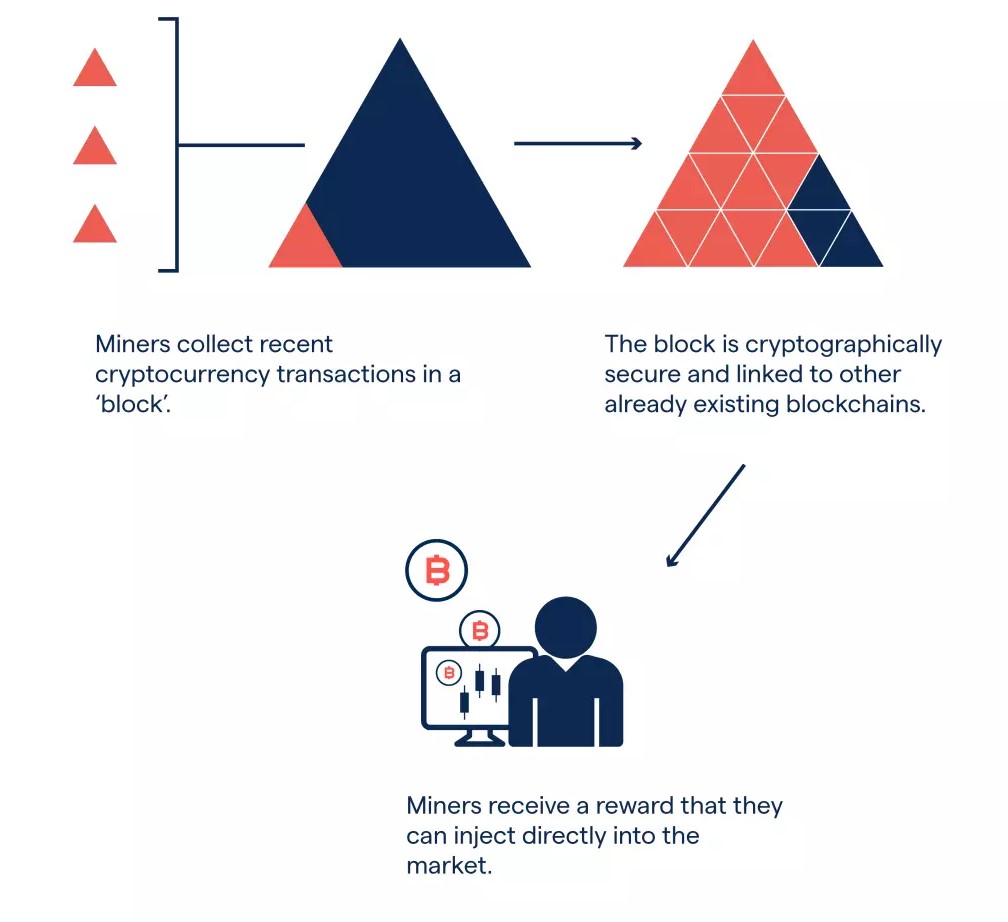

The cryptocurrency market is a decentralised digital currency network, which means that it operates through a system of peer-to-peer transaction checks, rather than a central server. When cryptocurrencies are bought and sold, the transactions are added to the blockchain – a shared digital ledger that records data – through a process called ‘mining’.

What moves cryptocurrency markets?

Cryptocurrency markets move according to supply and demand. However, as they’re decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. While there is still a lot of uncertainty surrounding cryptocurrencies, the following factors can have a significant impact on their prices:

Supply: the total number of coins and the rate at which they’re released, destroyed or lost

Market capitalisation: the value of all the coins in existence and how users perceive this to be developing

Press: the way the cryptocurrency is portrayed in the media and how much coverage it is getting

Integration: the extent to which the cryptocurrency easily integrates into existing infrastructure such as e-commerce payment systems

Key events: major events such as regulatory updates, security breaches and economic setbacks

Learn why people trade cryptocurrencies

Cryptocurrencies are notoriously volatile. For traders using leveraged derivatives that allow for both long and short positions, large and sudden price movements present opportunities for profit. However, at the same time, these also increase your exposure to risk. In short, the more volatile the market, the more risk you carry when trading it.

With IG, you can trade cryptocurrencies via a CFD account – derivative products that enable you to speculate on whether your chosen cryptocurrency will rise or fall in value. Prices are quoted in traditional currencies such as the US dollar, and you never take ownership of the cryptocurrency itself. CFDs are a leveraged product, which means you can open a position for just a fraction of the full value of the trade. Although leveraged products can magnify your profits, they can also magnify losses if the market moves against you.

When trading cryptocurrencies with us, you can:

Access real-time pricing. We derive our prices from several exchanges, and they’re calculated on a continuous basis

Get prices reflective of the underlying market. Because our prices are based on real markets, in real time, they always reflect actual market sentiment

Trade with derivatives. With our CFD account, you’ll never own actual cryptocurrencies. This means you get to trade without opening an exchange account or creating a wallet

Hedge against adverse markets. As CFDs enable you to take short positions, you can hedge against losses on investments you already hold

Obtain low spreads. We work to keep our spreads amongst the lowest in the market

Use continuous charting. Our award-winning platform1 offers cutting-edge HTML 5 charts and a selection of advanced indicators and drawing tools

Enter and exit positions quickly. Owing to tight spreads and our fast execution, CFDs enable you to enter and exit trades quickly

Trade on leverage and margin. CFDs are leveraged, giving you full market exposure at a fraction of the initial outlay required when buying actual cryptos. However, trading CFDs comes with a high risk of losing money rapidly due to leverage.

Trade on a secure platform. You can utilise measures such as the two-factor authentication (2FA) to ensure you’re secure when trading online.

Pick a cryptocurrency to trade

With us, you can use CFDs to trade 11 major cryptocurrencies, two crypto crosses and a crypto index – an index tracking the price of the top ten cryptocurrencies, weighted by market capitalisation.

Our selection includes:

Bitcoin

Ether

Bitcoin Cash

Litecoin

EOS

Stellar

Cardano

Bitcoin Cash/Bitcoin

Ether/Bitcoin

Crypto 10 index

Cardano

Chainlink

Polkadot

Dogecoin

Uniswap

Open a CFD trading account

Opening a CFD trading account usually takes minutes. And there’s no obligation to fund your account until you’re ready to trade. We’ve provided traders with access to leading financial markets since 1974 and are a FTSE 250 company.2

Find your crypto trading opportunity

Leading cryptocurrencies

Trade a selection of the world’s leading cryptocurrencies or our Crypto 10 index

Trade wherever, whenever

Deal on an award-winning trading platform and mobile app1

Technical indicators

Discover price trends using our in-platform tools like MACD and Bollinger Bands

Expert analysis

Get technical and fundamental analysis from our in-house team

Read Also: Keep your face towards the sunshine and shadows will fall behind you

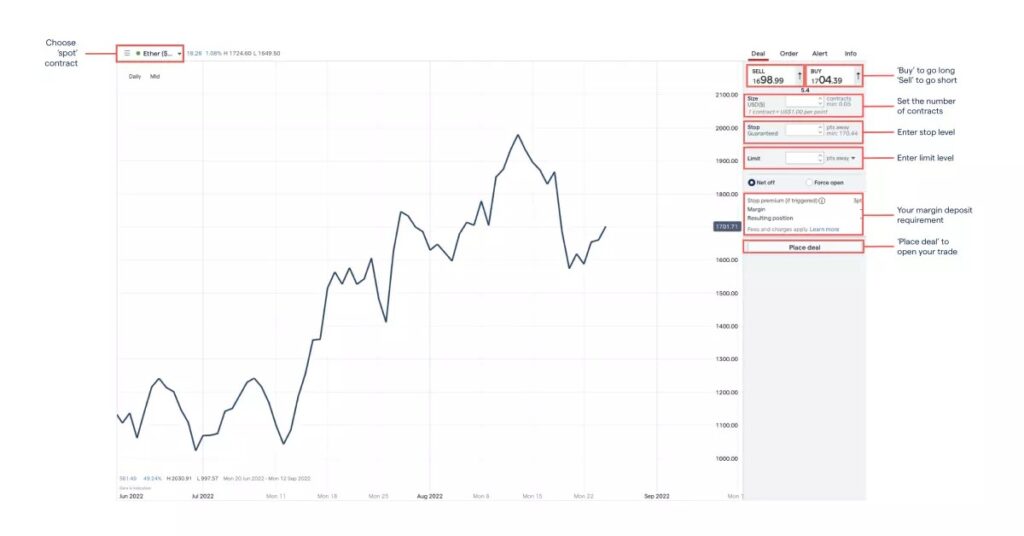

Decide whether to go long or short

‘Going long’ means you expect the cryptocurrency’s value to rise. In this case, you’d elect to ‘buy’ the market.

Take steps to manage your risk and place your trade

Because you’re opening your position on margin, you can incur losses rapidly if the market moves against you. To help manage this risk, you can set a stop-loss level in the deal ticket. If triggered, the stop-loss will automatically close your position and cap your risk.3

To lock in any profits if the market moves in your favour, you can also enter a limit level. Here, your trade will be automatically closed to secure positive returns as soon as the market reaches the price you’ve set.

Remember that, when trading CFDs, each contract will specify an amount per point of market movement. If the CFD is for AUD10 per point, and the underlying cryptocurrency price moves 10 points, your profit or loss – excluding costs – will be AUD100 per contract.

Once you’ve set the number of CFDs you want to trade, your stop-loss and limit levels, you’d open your position by clicking on ‘place trade’.

Monitor and close your position

When you decide to close a position, click on the ‘Positions’ tab on the left menu. Select ‘Close position’ and set the number of contracts you’d like to close. Alternatively, open the market’s deal ticket and take the opposite position to one you have open – for example, if you bought CFDs to open, you’d now sell, and vice versa.

Trading CFDs on cryptocurrencies: ether example

After completing a thorough analysis on ether price movements, you believe the market will trend upwards from its current level of 3200. Consequently, you decide to take a long position using CFDs. Because you’re going long, you open your position by electing to ‘buy’.

In this example, after a spread of 8 points is applied – and excluding other costs – the buy (or offer) price is set at 3204, while the sell (or bid) price is 3196. The CFD you use specifies an amount of AUD1 per point of market movement, and you opt to trade 10 contracts. This brings your total exposure for the position to AUD32,040 (AUD3204 x AUD1 per point x 10 contracts).

But, as positions on ether CFDs can be opened with a margin deposit of 50%, you’ll only need to deposit AUD15,020. At this point it’s important to note that because your exposure is larger than your required margin, you stand to lose more than the deposit if the market moves against you. So, to manage your risk, you can set a stop-loss to close your trade automatically.2 In this case, suppose you add a guaranteed stop loss at 3000.

The market moves as you predicted, up to a level of 3500, at which point you decide to close your position and take a profit. The sell (or bid) price after the spread is applied is 3496. The difference in price between 3496 and 3204 is 292 points. This, excluding other costs, brings your profit on the trade to AUD2920 – a return of 19.4% on your margin deposit.

Watch Also: https://www.youtube.com/@TravelsofTheWorld24

Leave a Reply